Digital Services

Accelerating digital transformation for the benefit of the client

The Societe Generale app L’Appli was awarded “Best stand-alone banking app worldwide 2014” by MyPrivateBanking Research, an independent Swiss cabinet who every year analyse over 200 mobile applications from 50 banks worldwide. The cabinet particularly appreciated the app’s ease of use and the suitability of the services on offer, which were a perfect match with users’ expectations.

In late 2014, Societe Generale was one of the first French banks to incorporate TouchID™ fingerprint recognition into its iPhone app. This innovation was released just weeks after the technology was opened to third-party programmers by Apple. As a result, users can take advantage of an additional level of security when displaying encrypted data from their “favourite account” (bank account or credi card balance, etc.). Additionally, the bank launched the L’Appli LAB, which allows clients to beta test new features, suggest improvements and actively participate in developing future enhancements to the L’Appli. The first service offered under this model, Mon enveloppe de dépenses (My Spending Budget), makes it possible to set a monthly budget and follow its progress daily.

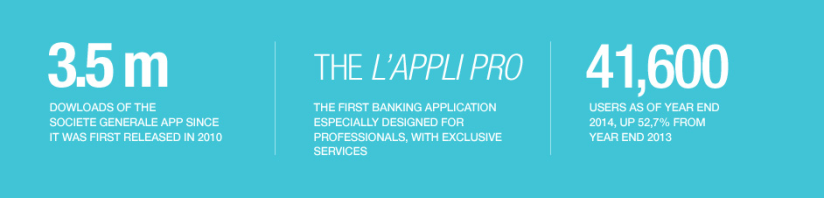

In the spring of 2015, Societe Generale took another step in its innovation strategy by releasing the latest version of L’Appli. It offers a total redesign and new features while maintaining a high level of security. Downloaded over 3.5 million times since its launch in late 2010, L’Appli now generates approximately 40 million logins per month.

INTERNATIONAL

ALD Mobile: a helping hand for drivers

ALD mobile is an application that helps drivers and makes day-to-day use of their vehicle easier. Available in 32 countries, it makes finding a service simple – whether petrol stations, garages, electric vehicle charging stations, etc. – and guides the user straight there. Drivers can also access information about services included in their contract, quickly contact the driver support platform, get information directly on their smartphone and make electronic reports in the event of an incident.

POLAND

Mobile payments with the Eurobank app

In Poland, fresh from its success at the top of the “2013 pocket banking apps” rankings, 2014 saw Eurobank adding a contactless payment feature using NFC (near field communication) technology to its mobile banking app. It also offers its clients a loyalty programme rewarding the most active users of this technology, all in a market where mobile solutions are highly popular.

ROMANIA

BRD makes health insurance easy

BRD launched MedCare in Romania in 2014, a corporate employee healthcare plan. The bank supports this plan with a mobile app, My MedCare, that makes it easier for members to manage their health on a day-to-day basis with unrivaled value-added services – such as a virtual “pillbox” to track treatments, a dedicated contact list for medical contacts and a geo-location search engine for finding care centres. An innovative tool helping to raise customer satisfaction thanks to support and a range of services found nowhere else!

MOROCCO

A loan direct from an ATM, thanks to your mobile

Have ready access to your loan via a Societe Generale Maroc ATM with your mobile phone instead of a card: this is the simple solution offered by consumer credit subsidiary EQDOM to its clients through the Mobiflouss service. Naturally, this service, which is completely secure thanks to a secret code sent to the mobile, is available only to those clients whose loan has already been approved.

CZECH REPUBLIC

KB launches a pioneering "E-trading" tool

In 2014 Komerční banka (KB), Societe Generale’s subsidiary in the Czech Republic, launched Alpha KB, an online trading tool aimed at SMEs, allowing direct access to exchange and hedging transactions for money-market products and foreign currencies. KB had already offered a pioneering direct trading solution in 2004 and, ten years later, the bank decided to upgrade its solution to better meet the needs of SMEs, a choice that once again places it a step ahead of its competition. Alpha KB was user tested with SME clients to ensure that the tool met their needs, using a collaborative approach among the bank’s teams. New developments are planned for the e-trading solution, which will also be launched in other countries.