Our mission is to serve our clients while managing risks effectively via a robust organisation and a risk culture that covers all the activities, markets and regions in which we operate.

Our goal is to provide high-quality and trustworthy customer service while ensuring sustainable growth for our Bank. To achieve this, Societe Generale takes a rigorous approach to risk management steered by the highest standards.

Types of risks

As part of its risk steering, Societe Generale regularly updates its risk typology and has grouped its risks into 6 main categories:

- risks associated with the macroeconomic, geopolitical, market and regulatory contexts;

- credit and counterparty risks;

- market and structural risks;

- liquidity and financing risks;

- non-financial and model risks;

- other risks, including those associated with insurance and long-term leases.

ESG risk management: constantly improving our methods

In the Group's risk taxonomy, ESG risks do not constitute a new risk category but represent a potentially aggravating factor for existing risk categories (such as credit risk, market risk, etc.) monitored as part of the Group's risk management. Their integration into the overall framework is based on existing governance and processes.

The Group's risk management system is continuously adapted to integrate new challenges.

ESG risk factors can be defined as follows:

- environmental risk factors are related to the quality and functioning of the natural environment and natural systems. They include factors such as climate change, biodiversity, energy consumption, waste management, etc. These environmental risk factors can have a detrimental financial impact through various risk factors. They can concern aspects of transition or physical risk;

- social risk factors concern the rights, well-being and interests of people and communities. They include factors such as (in)equalities, health, inclusion, labour relations, well-being and safety at work, human capital and communities;

- governance risk factors are related to governance practices (executive leadership, executive compensation, audits, internal control, tax policy, independence of the Board of Directors, shareholder rights, integrity, etc.) and how companies or entities include environmental and social factors in their policies and procedures.

These factors are liable to impact all of the Group’s businesses, its results and its financial situation in the short, medium and long term. Closely interconnected, they must be addressed holistically.

The Group analyses the potential impact of ESG factors on its counterparties, investments and own operations, prioritising issues identified by its double materiality analysis. This analysis enables it to identify priority impacts for the Group with regard to the environment and human rights (environmental and social materiality) and the effect on its economic and financial activities along its entire value chain (financial materiality).

A solid risk culture

The Group has put in place a rigorous and effective risk management organisation, crucial in all of its areas of activity, markets and regions. It aims to ensure a high degree of risk awareness and to promote innovation while complying with the required standards.

The main objectives are to improve profitability over the long term, ensure sustainability through an effective risk control mechanism and reconcile the independence of this risk management with close collaboration between the various business lines. In practice, this requires transparent governance, a precise definition of our risk appetite, appropriate control tools and constant efforts to increase risk awareness at every level of the Company.

Structured risk management

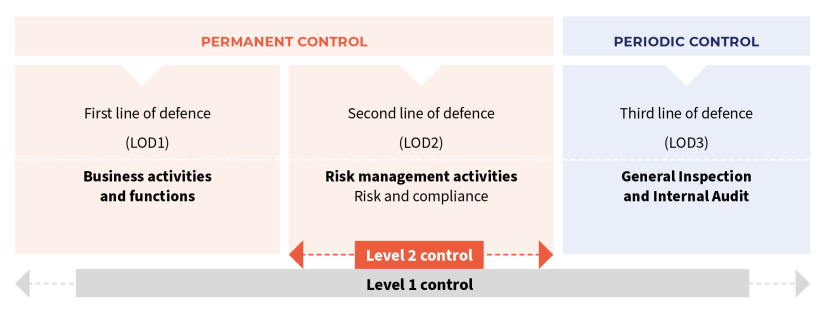

Within the Group, there are three main levels of risk management, ensuring rigorous governance and operational control of risks.

Every year, the Board of Directors approves the Group Risk Appetite Statement and Group Risk Appetite Framework. General Management, supported by the Group Chief Risk Officer and the Group Chief Financial Officer, oversees the implementation of the risk appetite, ensuring that the Group’s global strategy and risk supervision are aligned.

Control departments, and in particular the Risk and Compliance departments, are responsible for drafting risk management policies, putting in place control and monitoring systems and establishing frameworks for managing the various types of risk (strategic, compliance, financial).

At operational level, risk reporting systems enable regular and detailed monitoring suited to the Group’s organisational structure. These systems are vital for the effective communication of risk-related information and compliance with regulatory requirements.

A comprehensive internal control mechanism