Understanding our 2015 Q3 results

Frédéric Oudéa's editorial

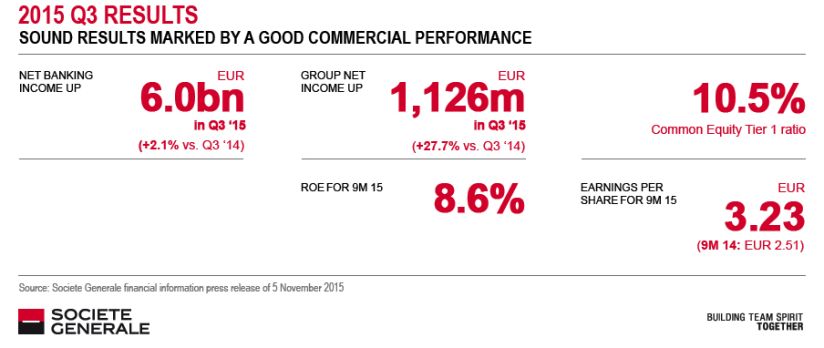

Our Group has posted sound results in Q3 2015 thanks to a good commercial performance and the continued control of costs and risks. We have provided further evidence of our growth potential against the backdrop of a recovery in Europe, with a substantial increase in our Retail Banking activities, both in France and internationally. Our revenues rose by 2.1% in the third quarter and by more than 7% in the first 9 months of the year. This growth is underpinned by the solid performance of our Retail Banking activities in France and internationally, Financial Services to Corporates and Financing & Advisory. However, challenging market conditions in the third quarter adversely affected our Global Markets businesses.

-

Our Group has posted sound results in Q3 2015 thanks to a good commercial performance and the continued control of costs and risks. We have provided further evidence of our growth potential against the backdrop of a recovery in Europe, with a substantial increase in our Retail Banking activities, both in France and internationally.

Our revenues rose by 2.1%* in the third quarter and by more than 7%* in the first 9 months of the year. This growth is underpinned by the solid performance of our Retail Banking activities in France and internationally, Financial Services to Corporates and Financing & Advisory. However, challenging market conditions in the third quarter adversely affected our Global Markets businesses.

At the same time, we continued to rigorously control our costs; our operating expenses increased by only 1.5% in the third quarter. Having completed our EUR 900 million cost savings plan for the period 2013-2015, we are embarking on a new phase for an additional reduction of EUR 850 million over 2015-2017. Our aim is to give ourselves sufficient flexibility to absorb regulatory shocks but, more importantly, to enable us to finance the development of our businesses and our digital transformation. As for the cost of risk, it continues to decline (-11% in the third quarter).

Overall, we generated Group net income of EUR 1.1 billion in the third quarter, up by nearly 28% compared with the same period last year. Earnings per share (EPS) comes to EUR 3.23 in the first 9 months of the year and exceeds the total for 2014. This is the basis for the calculation of the proposed 50% dividend payout ratio to be submitted to the Board of Directors and the Annual General Meeting.

These good results enable us to continue to bolster our capital: our CET 1 ratio now stands at 10.5%, in line with our target of around 11% at end-2016.

Going forward, we are going to accelerate our digital transition, particularly in French Retail Banking. The emergence of digital has radically transformed the behaviour and expectations of our customers. There has been a substantial decline in branch visits, whereas the number of email exchanges and web or mobile connections has soared.

To accelerate this digital transition, we will leverage on the complementary nature of our three brands: Societe Generale, Crédit du Nord and Boursorama. We will capitalise, on the one hand, on Boursorama’s leadership position in online banking in order to continue to acquire new customers and, on the other hand, on the transformation of our relationship model in our Retail Banking networks. The Societe Generale network will therefore adapt and remodel its branch format. The branch’s role will be focused more on proactive and value added advice. This change in the branches will be accompanied by the optimisation of the network. At the same time, the Group will launch several digital initiatives and invest more than EUR 1.5 billion between now and 2020 in the digitalisation of processes, marketing and data security, and strengthening Fintech ties through partnerships and acquisitions.

Our employees will have a key role in this transformation and we will accompany them, notably by adapting the recruitment process, implementing training programmes and helping with the change management process.

With this transformation, the Group aims to enhance and improve the customer relationship, thanks to greater simplicity, greater reactivity, greater expertise and greater freedom of choice via an omni-channel approach. Over the next few quarters, we intend to pursue this strategy focused on the customer and the creator of long-term value. We will continue to capitalise on the robust growth of our businesses and bolster our capital.

I would once again like to thank you for your loyalty and the trust you have placed in our Group.

Frédéric Oudéa,

Chief Executive Officer* When adjusted for changes in Group structure and at constant exchange rates

Results by business

Sound results marked by a good commercial performance.

French Retail Banking

International Retail Banking & Financial Services

Global Banking & Investor Solutions

Interview with Frédéric Oudéa

CEO Frédéric Oudéa commented on the Group’s 2015 Q3 results in an interview he gave to EuroBusinessMedia (CEO-Direct).

Strategy

Launch of Amundi's initial public offering

The initial public offering of Amundi, the leading European asset manager, was launched on 2 November 2015 on the regulated market of Euronext Paris. As provided for under the shareholders’ agreement entered into upon Amundi’s creation, Societe Generale plans to sell the entire 20% it holds in Amundi. The two companies will remain bound by their distribution agreements, which have been extended for a renewable period of five years from the completion date of the IPO. In so doing, Societe Generale has reaffirmed its long-term industrial partnership with Amundi, which will remain its chosen provider of savings and investment solutions to its retail banking and insurance networks.

Innovation

Societe Generale: first partner in residence of PLAYER, a place to instigate innovation together

Since May 2015, Societe Generale has been a partner in residence of PLAYER, which is located at the heart of the Sentier district, one of the leading “French Tech” hubs in Paris. As a resident, Societe Generale has access to an extensive field of acculturation, experimentation and hybridisation for its members of staff.

Awards

Societe Generale winner of the 2015 Shareholder Club Award

As part of the 2015 Shareholder Relations Awards, the fifth edition of this event organised by Les Echos and Investir/Le Journal des Finances in partnership with audit firm Mazars, Societe Generale has been awarded the 2015 Shareholder Club Prize for the best ways of communicating with individual shareholders.

CSR

Towards an inclusive and green economy

The Positive Impact Manifesto by the United Nations Environment Programme Finance Initiative is supported by Societe Generale. The Manifesto invites banks and other financial sector players to think more holistically about their role in the economy, society and the broader environment.

Sports sponsorship

Live from Rugby World Cup 2015, Societe Generale celebrating team spirit

Societe Generale, having been committed to rugby for almost thirty years, was behind the scenes to share the highlights and emotions of this exceptional event held in England from 18 September to 31 October. The Group was one of six Worldwide Partners as well as the sole banking, financial and insurance partner, and involved its shareholders.