Understanding our 2015 Q2 results

Frédéric Oudéa's editorial

Societe Generale has produced very good results during the first half of 2015 due to the commercial dynamism of all the businesses. At the same time, our Group has continued to strengthen its balance sheet. We are therefore well positioned to capitalise on the economic recovery in Europe. All our Group’s businesses are in line with their targets, with the sole exception of Russia where the situation is gradually normalising.

-

Societe Generale has produced very good results during the first half of 2015 due to the commercial dynamism of all the businesses. At the same time, our Group has continued to strengthen its balance sheet. We are therefore well positioned to capitalise on the economic recovery in Europe. All our Group’s businesses are in line with their targets, with the sole exception of Russia where the situation is gradually normalising.

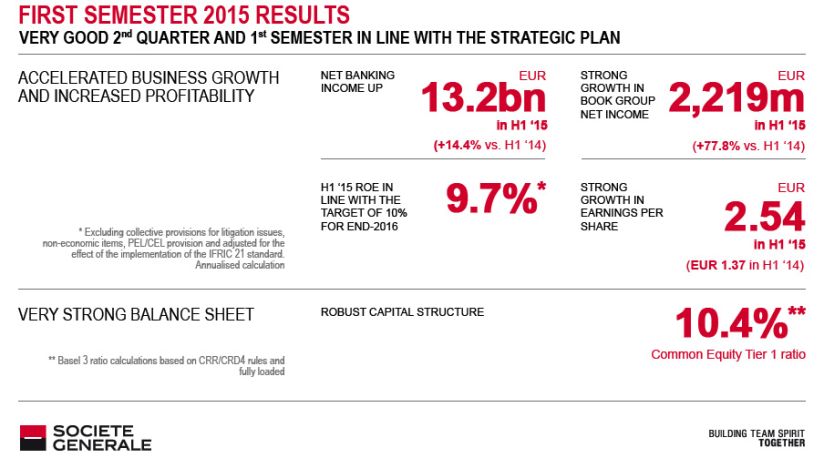

In H1 2015, our Group generated revenues up by more than 14% thanks to the positive contribution of our three major businesses: French Retail Banking, International Retail Banking & Financial Services and Global Banking & Investor Solutions. We therefore generated Group net income of EUR 2.2 billion in H1, up by nearly 78%. Earnings per share, EPS, amounts to EUR 2.54 which is substantially higher than in H1 2014 (EUR 1.37).

French Retail Banking provided further confirmation of its commercial dynamism with strong growth in outstanding deposits and a proactive approach to winning new customers: our three brands (Societe Generale, Crédit du Nord and Boursorama) opened a total of 185,000 current accounts in H1. Finally and for the first time for several quarters, French Retail Banking’s outstanding loans started to increase (+1.3% in Q2).

International Retail Banking & Financial Services’ revenues increased by more than 2% in H1, when adjusted for changes in Group structure and at constant exchange rates, due to the strong commercial momentum in our retail banking networks in Western Europe, the Balkans and Africa. Activity was also buoyant in Financial Services to Corporates and Insurance. In Russia, the economic environment remains deteriorated but commercial activity is gradually picking up and the cost of risk is declining.

Global Banking & Investor Solutions posted an increase in revenues of nearly 9% in H1, when adjusted for changes in Group structure and at constant exchange rates, primarily due to the very good performances of equity market activities and Financing & Advisory. For example, natural resources financing enjoyed an excellent quarter, marked by major project financing transactions.

Operating expenses remained under control and we have secured 97% of the objectives of our EUR 900 million cost savings plan. We have decided to extend it, with an additional reduction in our operating expenses of EUR 850 million over the period 2015-2017. As for the commercial cost of risk, it was substantially lower at 49 basis points vs. 61 basis points in H1 2014.

Midway through its strategic plan, our Group is on track to achieve all its targets, and in some cases exceed them. Our pro forma ROE, a key measure of our Group’s profitability, stood at 10.3% in Q2, in line with the target of 10% for end-2016.

In the coming months, we will continue to place the customer and digital at the heart of the transformation of our business model. Our priorities will be to capitalise on the expected rebound in Europe, roll out our digital strategy in all our businesses and continue to improve our operating efficiency. Our aim is to generate profitable growth in order to serve our customers and shareholders. We have confirmed our objectives in the continuation of our plan. Given EPS of EUR 2.54 and a 50% payout ratio, we have already secured a dividend provision of EUR 1.27 per share which is more than for the whole of 2014.

I would like to thank you for your loyalty and the trust you have placed in our Group.

Frédéric Oudéa,

Chief Executive Officer

Results by business

Good second quarter and first semester in line with the strategic plan.

French Retail Banking

International Retail Banking & Financial Services

Global Banking & Investor Solutions

Interview with Frédéric Oudéa

CEO Frédéric Oudéa commented on the Group’s 2015 Q2 results in an interview he gave to EuroBusinessMedia (CEO-Direct).

Strategy

Committed to entrepreneurs

Societe Generale's commitment to entrepreneurs means helping their companies grow and contributing to their long-term success. Leveraging its strong local presence and its committed teams, Societe Generale works side by side with entrepreneurs, assisting with day-to-day management and supporting them at key junctures.

Innovation

The connected bank, partner of the 2015 "Futur en Seine" Festival

As the first and only bank to be a partner of “Futur en Seine”, Societe Generale had its own stand from 11 to 14 June at the largest digital festival in Europe. Each year, “Futur en Seine” showcases the latest French and international digital innovations for professionals and the general public alike.

Awards

"Best Private Bank in Europe" – once again!

Societe Generale Private Banking has won another major award, receiving the title of “Outstanding Private Bank – Europe” from Private Banker International magazine. The award comes just after April's awards from WealthBriefing as a continued recognition of Societe Generale Private Banking's leadership in wealth management and of the professionalism of its teams.

Sports sponsorship

Countdown to Rugby World Cup 2015

On 18 September, England will play Fiji in the inaugural match of the Rugby World Cup, of which Societe Generale is a Worldwide Partner. Are you ready to live and breathe rugby? Meet the people already getting ready for the event, get an inside view of the recent Group events, and test your knowledge with the first episodes of "Do you speak rugby?".

Citizenship

"Citizen Commitment Time", an international solidarity relay event

“Citizen Commitment Time”, Societe Generale's main solidarity initiative, was held from April to the start of July. Overall, 109 events were organised in 38 of the countries where the Group is present, with more than 6,800 employees giving their time and energy to support different associations. They covered more than 88,000 kilometres in the sporting and solidarity challenges and more than €431,000 were raised in support of the Group's partner associations who use sports or cultural activities to promote the integration of people in difficulty.

Glossary

APPLICATION OF THE NEW ACCOUNTING STANDARD AND NEW REGULATORY

TLAC: The TLAC “Total Loss Absorbency Capacity” is a ratio which contents will definitely be known in November 2015 at the latest, once the final rules are released by the Financial Stability Board. It will frame the minimum amount of regulatory capital and eligible debts to the ratio (long term debts mostly including strong subordination features) that each Global Systematically Important Bank will have to hold, thus making possible the exercise of the bail-in powers to recapitalize the firm in case of a possible entry into resolution.

IFRIC 21: Under IFRIC 21, which took effect on 1 January 2015, all taxes due must be recorded once the obligating event has occurred, whereas previously they could be spread out over the entire year.

Single Resolution Fund (SRF): The regulation governing the single resolution system for the euro zone calls for the establishment of a single resolution fund in the amount of 1% of all euro zone covered deposits within 9 years, for an estimated total of EUR55 billion. Societe Generale's contribution was pro-rated for the share of the bank's balance sheet (excluding shareholders' equity and covered deposits) relative to the total for all equivalent euro zone balance sheets.