Understanding our 1st Quarter 2017 Results

Frédéric Oudéa's editorial

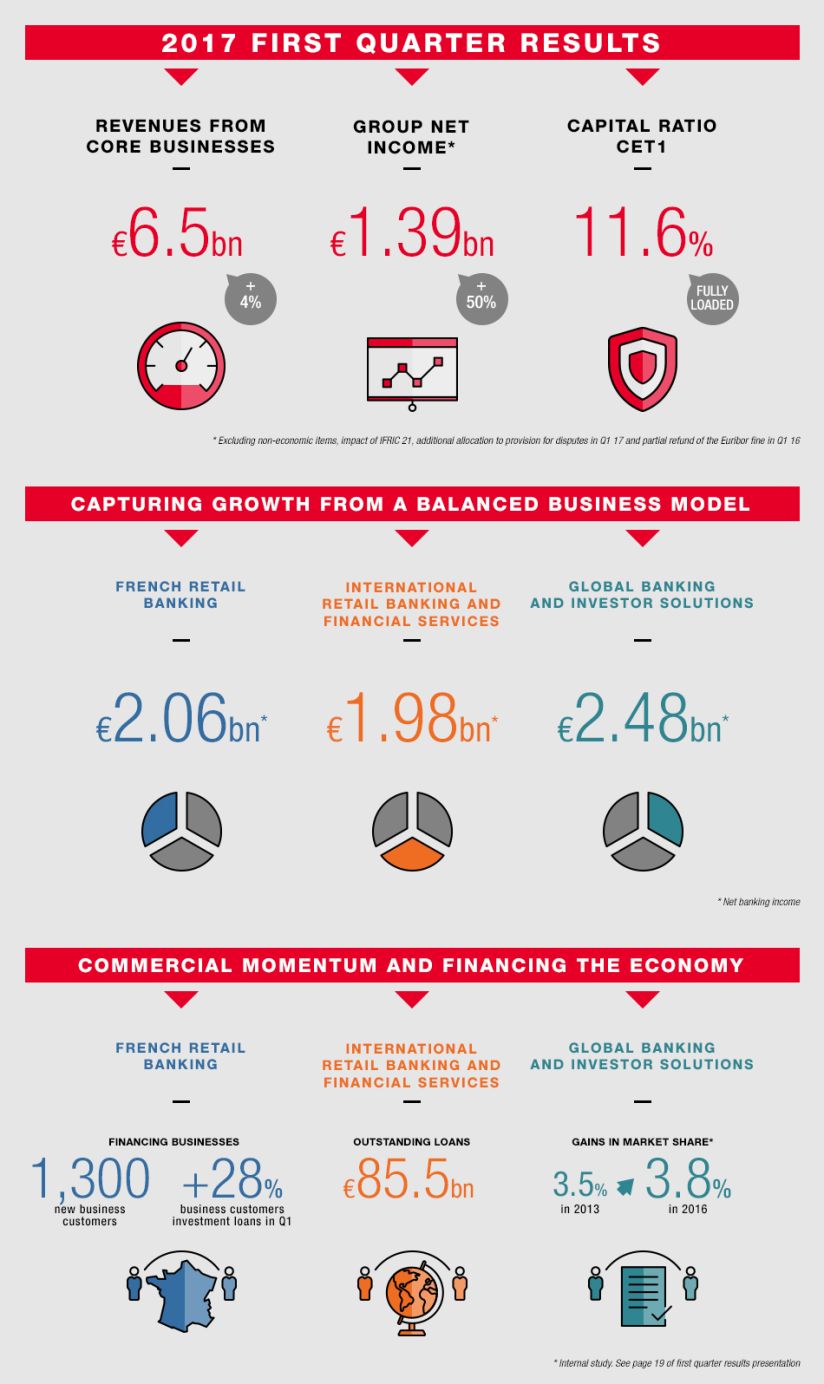

Societe Generale's results for Q1 2017 once again demonstrate the quality of its diversified and integrated banking model, with a good performance in all its businesses. Strong growth in International Retail Banking & Financial Services and solid revenues in Global Banking & Investor Solutions more than offset the negative impact of low interest rates in French Retail Banking. Based on the increase in revenues and the control of its costs and risks, Group net income was substantially higher, excluding the impact of disputes.

-

Dear Shareholder,

Societe Generale's results for Q1 2017 once again demonstrate the quality of its diversified and integrated banking model, with a good performance in all its businesses. Strong growth in International Retail Banking & Financial Services and solid revenues in Global Banking & Investor Solutions more than offset the negative impact of low interest rates in French Retail Banking. Based on the increase in revenues and the control of its costs and risks, Group net income was substantially higher, excluding the impact of disputes.

French Retail Banking delivered a good commercial performance: the traditional banking networks (Societe Generale, Credit du Nord) saw a 2% rise in new individual customers while Boursorama set a new acquisition record with 80,500 new customers in Q1 17 (+32%), thereby strengthening its position as the leading online bank in France, with more than one million customers at end-March 2017. In the business segment, the Societe Generale and Credit du Nord networks also experienced an increase, with nearly 1,300 new relationships in Q1 17 (+7.7% vs. Q1 16).

As in previous quarters, International Retail Banking & Financial Services benefited from strong growth in all regions and businesses: increase in International Retail Banking’s outstanding loans particularly in Europe and Africa and rise in life insurance savings outstandings, while Equipment Finance’s outstanding loans were also up.

Global Banking & Investor Solutions operated in a contrasting market environment during Q1 2017. Investors were active at the beginning of the quarter before political uncertainty around the elections in Europe led to a certain “wait-and-see” attitude in the markets. However, Global Banking & Investor Solutions’ revenues increased more than 5%, highlighting the robustness of the business model.

There was a controlled increase in operating expenses of +1.4% in Q1 2017, reflecting the acceleration of investments in French Retail Banking, the increased activity in International Retail Banking & Financial Services, and the effects of Global Banking & Investor Solutions’ cost savings plans.

Overall, we generated Group net income of EUR 747 million in Q1 17 (including an additional allocation to provision for disputes of EUR 350 million) and we achieved a Common Equity Tier 1 ratio of 11.6%, up 10 basis points in Q1.

We would remind you that we will propose the payment of a dividend of €2.20 per share in respect of the 2016 financial year to the General Meeting on 23rd May. This represents a 10% increase compared to 2015.

The Group is also continuing with its transformation and will present its new medium-term strategic plan on 28th November 2017. It has initiated a process to simplify its organisational set-up which will enable it to even better serve its customers, increase its agility and innovative capacity, and continue to exploit synergies between its businesses. Finally, over the next few quarters, the Group will continue actively working to bring an end to past disputes and complete the Culture and Conduct projects in order to further enhance the quality of its services and the control of its risks.

Once again, I would like to thank you for your loyalty and the trust you have placed in our Group.

Frédéric Oudea,

Chief Executive OfficerVariations are based on adjustments for changes in Group structure and at constant exchange rates compared to 2016.

Results by business

Good commercial and financial performance from core businesses

French Retail Banking

International Retail Banking & Financial Services

Global Banking & Investor Solutions

Viewpoint

Societe Generale: aligning more closely with business leaders

Laurent Goutard, Head of Societe Generale Retail Banking in France. Societe Generale supports companies experiencing growth, helping them develop their business and conquer new markets.

Expert opinion

Brexit: it's only just begun...

Brexit is now unavoidable. Theresa May has officially triggered Article 50 of the Treaty on European Union, providing notification of the United Kingdom’s withdrawal from the European Union by 29 March 2019, following two years of negotiations.

Innovation

Le Plateau

Le Plateau, located in the Dunes complex, has an important place in the network of existing external coworking sites. To foster cooperation between internal and external project teams and FrenchTech ecosystems, Le Plateau hosts external and internal startups in an innovative environment, providing support and making its resources available to them.

Commitments

Diversity & Performance

Societe Generale Group is developing an active diversity policy, notably in terms of gender parity. Beyond the ethical and societal issues, the conviction has emerged that innovation and achievement start with the sharing of ideas between people of varied profiles. Discover employees’ perspectives on this issue and their viewpoints on the role of women in a changing workplace.