The fight against climate change

Climate Strategy

Since 2015 and the Climate Change Conference in Paris (COP21), the financial sector has been subject to special attention from the legislator, which has strengthened the connection between financial and climate-related issues.

In light of the acceleration of climate change, underscored in the most recent report by the Intergovernmental Panel on Climate Change (IPCC), and as announced in the Katowice Commitment with four other banks during the COP 24 in Poland , Societe Generale shares the goal set out in the Paris Agreement to require financial flows to be in line with “a trend towards lower greenhouse gas emissions and greater resilience to climate change”.

Societe Generale is committed to be a part of this change, by awarding more financing to projects designed to create a sustainable and inclusive economy. The Bank’s specific TCFD (Task Force on Climate-related Financial Disclosures) report details Societe Generale’s commitments and achievements in this field.

INTEGRATED REPORT 2019-2020 - POSITIVE CLIMATE ACTION SUPPORTING A FAIR, ENVIRONMENTALLY FRIENDLY AND INCLUSIVE TRANSITION

UNIVERSAL REGISTRATION DOCUMENT 2020 – CHAPTER 5, POSITIVE CLIMATE ACTION: SUPPORTING A FAIR, ENVIRONMENTAL AND INCLUSIVE TRANSITION

SOCIETE GENERALE’S TCFD REPORT 2019

KATOWICE COMMITMENT

Reducing activities related to fossil fuels

As from 2015, Societe Generale has committed to strive to put the Bank’s action on course to achieve the scenario whereby global warming is limited to 2°C by 2020. With this commitment, the Group aims to implement governance, risk management and risk monitoring tools to enable it to respond in the most appropriate way to a carbon-free economy resilient to the effects of climate change.

In addition, the Group is committed to progressively reduce to zero its exposure to the thermal coal sector, at the latest in 2030 for companies with thermal coal assets located in EU or OECD countries and 2040 elsewhere.

Coal

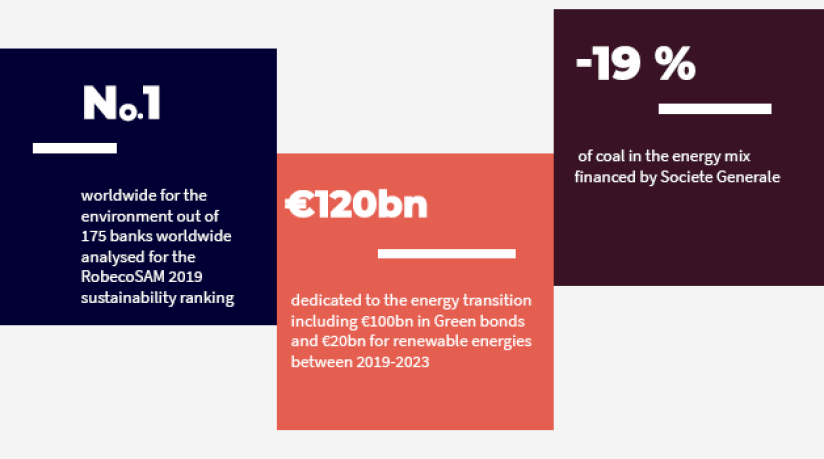

By the end of 2018, with two years in advance, Societe Generale reached the goal of limiting to 19% its coal-fuelled part of its financed energy mix for power production.

Societe Generale is continuing its policy of disengagement from coal with the cessation of the supply of new services or products to client companies mainly linked to thermal coal and to companies in transition that do not have an explicit strategy of diversification. In terms of its financing portfolio, the Group is committed to reducing its exposure to the thermal coal sector to zero by 2030 for EU and OECD countries and 2040 for the rest of the world.

In so doing, the Group seeks to position itself as one of the key players in the fight against climate change, by supporting clients with their energy transition.

AN ACCELERATED EXIT FROM THE COAL SECTOR

SECTOR POLICY ON COAL (2019)

Oil and gas

In 2018, Societe Generale decided to end financing for the production of oil from oil sands around the world as well as for all types of oil production in the Arctic.

Shipping

In 2019, Societe Generale contributed to the development of and signed the Poseidon Principles. These principles provide a framework for integrating climate considerations into lending decisions in the sector to promote the decarbonisation of international shipping. The Poseidon Principles are consistent with the goal of the International Maritime Organization (IMO) to reduce greenhouse gas emissions from the shipping sector by at least 50% by 2050.

Societe Generale also announced that it had joined the Getting to Zero coalition, which aims to develop and deploy commercially-viable deep-sea zero-emission vessels by 2030.

Reinforcing our commitments

In 2019, Societe Generale intensified its action in the construction of a sustainable and climate-resilient future by signing the Principles for Responsible Banking and joining the Collective Commitment on Climate.

As a demonstration of this commitment, the Bank commits to raising €120 billion to the energy transition between 2019 and 2023.

RobecoSAM's 2019 annual sustainability ranking is recognition of the Bank's success in incorporating CSR policy into the Group's strategy. Societe Generale was ranked 1st place worldwide on environmental topics and in 6th place in Europe for all ESG (Environmental, Social and Governance) matters, out of the 175 banks analysed.

SOCIETE GENERALE ACCELERATES ITS COMMITMENTS IN FAVOUR OF A RESPONSIBLE ECOLOGICAL TRANSITION

ROBECOSAM SUSTAINABILITY RANKING: SOCIETE GENERALE BEST BANK WORLDWIDE FOR ENVIRONMENTAL DIMENSION

Frédéric Oudéa explains the importance of signing the Principles for Responsible Banking

Societe Generale is proud to be a Founding Signatory of the Principles for Responsible Banking, committing to strategically align its business with the Sustainable Development Goals set by the United Nations and the Paris Agreement on Climate Change. The six Principles are supported by a strong implementation framework that defines clear lines of accountability and requires each bank to set, publish and work towards ambitious targets.