Blockchain and cryptoassets overview

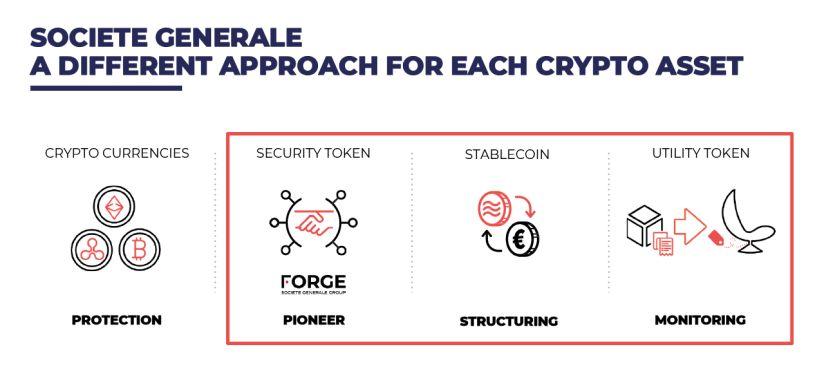

Societe Generale is interested in the Cryptoasset sector. The company, which has always been at the forefront of detecting and monitoring emerging technologies, considers that blockchain has now become a mature ecosystem since bitcoin, the first blockchain, was created in 2008. The Group develops services around cryptoassets (excluding cryptocurrencies) for over 3 years.

Blockchain

Blockchain is to data storage what the internet was to the physical world: a revolution! It can be compared to an online spider web where all the nodes correspond to data storage.

Societe Generale continues to explore the potential of blockchain which has many advantages: it is decentralized, secure, stable, traceable, transparent, fast and reliable. It has the potential to radically improve some financial procedures that are still slow and costly.

There are currently more than a hundred protocols in blockchain (Tezos, Ethereum, Cardano, Bitcoin, etc.). It is difficult to know at this time, if one of them in particular will emerge as market leader. However, 5 or 6 of them currently dominate the market.

Blockchain can be public or private. Public blockchains are to private blockchains what the internet network is to the intranet network.

Blockchain has led to the emergence of cryptoassets

Cryptocurrencies, which represent 80% of the cryptoasset market, are highly volatile and speculative assets. Societe Generale does not currently distribute cryptocurrencies, an asset class that involves a certain investment risk, because of its focus on customer service. Security tokens are financial security tokens: this is the asset class where Societe Generale - FORGE is active. Cryptoassets also include Stablecoins, a currency exchange system with a stable value. Finally, Societe Generale is currently monitoring the market for Utility tokens, which are usage rights.

In a visionary and innovative approach, Societe Generale has detected a true transformational opportunity to develop significant new business models in cryptoassets and blockchain (for example, Coinbase has been valued at 60 billion dollars!). It is working in close collaboration with the regulator in an experimental context.

Cryptocurrencies

Societe Generale does not provide these services. However, even if the company does not want to operate in this field, after listening to its clients’ needs, it is offering a bank account aggregation service for these platforms, such as Coinbase, Binance and Kraken), via its subsidiary Boursorama.

Security tokens

In just three years, Societe Generale has developed a platform (Societe Generale - FORGE) that offers three types of services: structuring and issuing financial instruments in crypto format, the ability to exchange these assets and digital storage of these assets.

There are two types of security tokens: native security tokens are financial securities which only exist digitally on blockchain, while asset back tokens are digital representations of financial securities that exist elsewhere. In the interests of choosing disruptive business models to better serve its customers, Societe Generale - FORGE has chosen to offer services in this first category.

To achieve its ambitions, Societe Generale has tested blockchain in order to optimise the bond issue circuit. For example, in April 2019, Societe Generale - FORGE issued a digital bond of 100 million euros on the public blockchain, Ethereum.

In May 2020, it conducted a second experiment via a (40-million-euro) bond issue on a public blockchain settled this time in CBDC issued by the Banque de France.

Still continuing with this dynamism, the red and black bank launched two new operations in April 2021. It formed a banking syndicate with Goldman Sachs and Santander for a 100-million-euro digital bond issue on the public blockchain, Ethereum, through the EIB (European Investment Bank). In addition to the bond issues, Societe Generale - FORGE has successfully completed a new stage in its development by issuing the first structured product on the public blockchain, Tezos. In accordance with the best market standards, this new test demonstrates the legal, regulatory and operational feasibility of issuing complex financial instruments (structured products) on public blockchain. It capitalises on a disruptive technology that improves the efficiency and fluidity of financial transactions.

Societe Generale conducts its blockchain transactions using the CAST (compliant architecture for security tokens) protocol.

Stablecoins

Stablecoin is a currency that is pegged to a stable value. It is therefore programmable. For example, in its constant search to set itself apart from the crowd through innovative initiatives, Societe Generale has supported the digital currency, Lugh of Casino. Another form of Stablecoin is the Central Bank Digital Currency (CBDC) which is issued on a DLT. There are two categories of CBDCs: CBDCs for interbank settlements (wholesale CBDCs) and retail CBDCs (payments to individuals and businesses). Today, all the central banks are working on these CBDCs. Societe Generale is active on wholesale CBDCs (Societe Generale - FORGE is taking part in the Banque de France’s experiments) and is waiting for ECB to decide on the retail CBDCs (in view of the major macroeconomic risks for retail CBDCs).

Find out more on crypto

-

Press briefing overview of crypto assetsDownload .PDF 1.12 MB