Strategy

For more than 160 years, Societe Generale has been supporting its clients in their projects and offering them a range of financial products and services in France and abroad. The Group’s CSR strategy is based on four pillars: the environmental transition, positive local impact, being a responsible employer and the culture of responsibility within all its activities. This strategy is supported by governance led at the highest level by the Board of Directors, including a non-voting director whose role is to assist Board members with their missions in the field of CSR.

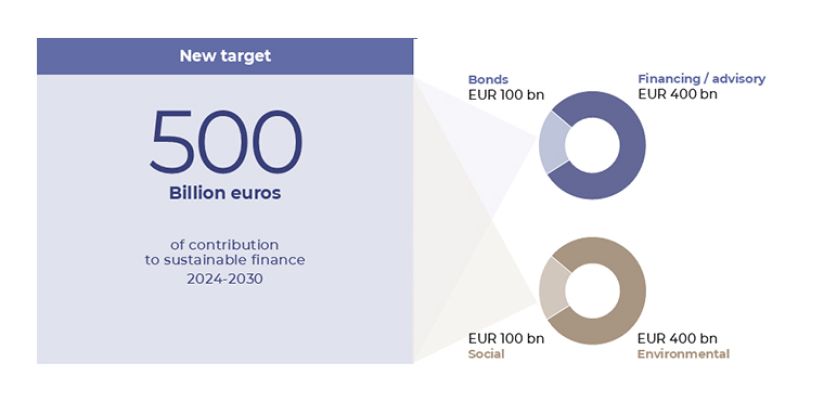

Societe Generale’s 2026 strategic plan aims to make the Group a top tier European bank, rock-solid and delivering sustainable performance. Within this context, it has announced several ESG ambitions including:

- a contribution of 500 billion euros to sustainable finance over 2024-2030. A large part of this financing will be devoted to transactions dedicated to low-carbon energy, sustainable real estate, low-carbon mobility and issues relating to industry and the environmental transition (for further information, see the “Supporting the transition” page);

- a reduction in fossil fuel exposure and greater efforts to align the Group’s credit portfolios with pathways consistent with the objectives of the Paris Agreement (for further information, see the “Decarbonising activities” page) ;

- investments for the transition, notably with an envelope of 1 billion euros, comprising an equity investment component of 700 million euros. The purpose of this envelope is to support emerging players, new green technologies, nature-based solutions and impact-driven investments (for further information, see the “Supporting the transition” page);

- an envelope of 100 million euros to reduce the gender pay gap. As a responsible employer, the Group wants to establish a culture of performance and responsibility and amplify its actions in favour of gender diversity. It has thus allocated 100 million euros to reducing the pay gap between men and women. Furthermore, the Group has set an ambition of having over 35% of women within the Group Leaders Circle (or Top 250) by 2026 (for further information, see the “Responsible employer” page);

- the development of partnerships and participation in international initiatives. Societe Generale has notably signed a collaboration agreement with IFC (International Finance Corporation), a member of the World Bank Group, to accelerate sustainable finance in developing countries. The partnership aims to support sustainable finance projects that facilitate access to energy, water and other critical infrastructures;

- the creation of a Scientific Advisory Council to enhance the Group’s thinking in the field of ESG and key trends influencing the Group, by providing long-term perspectives and scientific-based advisory;

- the development of philanthropic actions within the Group, in particular through its corporate Foundation, whose resources have been increased, to strengthen support for culture, education and professional integration and to open up a new field of intervention in environment, focusing more specifically on the preservation of the oceans. Since 2024, and for five years, the Societe Generale Foundation has supported The Ocean Cleanup as a ‘Mission Partner’, with the aim of raising awareness and taking action for a sustainable future (for further information, see the “Societe Generale Foundation” page).

Societe Generale is also targeting a 50% reduction in its own carbon footprint between 2019 and 2030 (for further information, see the “Own account” page).

Furthermore, the Group is committed to preserving biodiversity and natural resources by incorporating environmental norms and standards within its activities and by supporting sustainable financial solutions and collective initiatives (for further information, see the “Nature” page).

Supporting our clients

The decarbonisation of our economies depends on colossal investment needs. It therefore requires collective intelligence and a co‑construction effort between the various players. For almost 20 years now, the Group has been facilitating access to renewable energies via the financing of numerous projects around the world.

The challenge is to support the Group’s clients in their transition to a low-carbon economy, by developing innovative solutions to finance the changing economy. With this in mind, the Group's banking offering is being expanded with the aim of meeting clients' financing, investment and financial services needs.

For further information, see the “Supporting the transition” page

Read the Sustainable Finance Client brochure

Supporting the local economy

A longstanding bank for entrepreneurs, the SG network in France supports the local economy and helps managers at key moments in the development and transfer of their business, supported by 360° schemes, SG Entrepreneurs and SG Entrepreneurs Tech, locally-based CSR directors and Regional Business Centres. Additionally, entrepreneurs benefit from the expertise of a global banking group.

Societe Generale, through its retail bank SG, offers a number of products and services to help individual clients make the transition. These include an energy renovation support programme, sustainable financing through subsidised loans and leasing, and a range of responsible savings products.

The Group supports regional development in countries in which it is established by offering a range of products enabling SMEs to be supported in their transitions through financing and solutions studied with partners.

Moreover, the SG retail bank is recognised for the support it provides to social economy players, including large associations and financial institutions, with sectoral know-how and a business centre devoted to institutionals in Ile-de-France (Paris and surrounding region).

With regards to global banking and investor solutions, Societe Generale supports the development of critical infrastructures by financing projects associated with health, access to energy and access to water through sustainable bonds and responsible financing solutions.

Further insights

Over 20 years of commitment to the ecological transition

UNEP-FI

Participation in the United Nations Environment Program Finance initiative (UNEP FI)

Equator Principles

Project finance

COP 21

Coal sector policy, alignment with IEA 2°C scenario

Science-based targets

Setting emissions reduction targets

Katowice Commitment

5-bank pledge to align lending portfolio with Paris Agreement

Principles for responsible banking, collective commitment on climate action

Founding signatory and core member defining the principles

Poseidon Principles, Getting to Zero Coalition

Decarbonising the shipping industry: founding signatory

Sustainable IT Charter

Limiting environmental impact of technology and promoting digital inclusion

Hydrogen Council

Supporting the development of hydrogen for energy transition

Net-Zero Banking alliance (UNEP-FI)

One of the founding members

Sustainable Steel Principles

One of the founding members

Participation in working groups: Aluminum Climate-Aligned Finance & Aviation Climate-Aligned Finance

Act4nature

18 biodiversity commitments

Recognised commitment