Understanding our 2017 second quarter results

Frédéric Oudéa's editorial

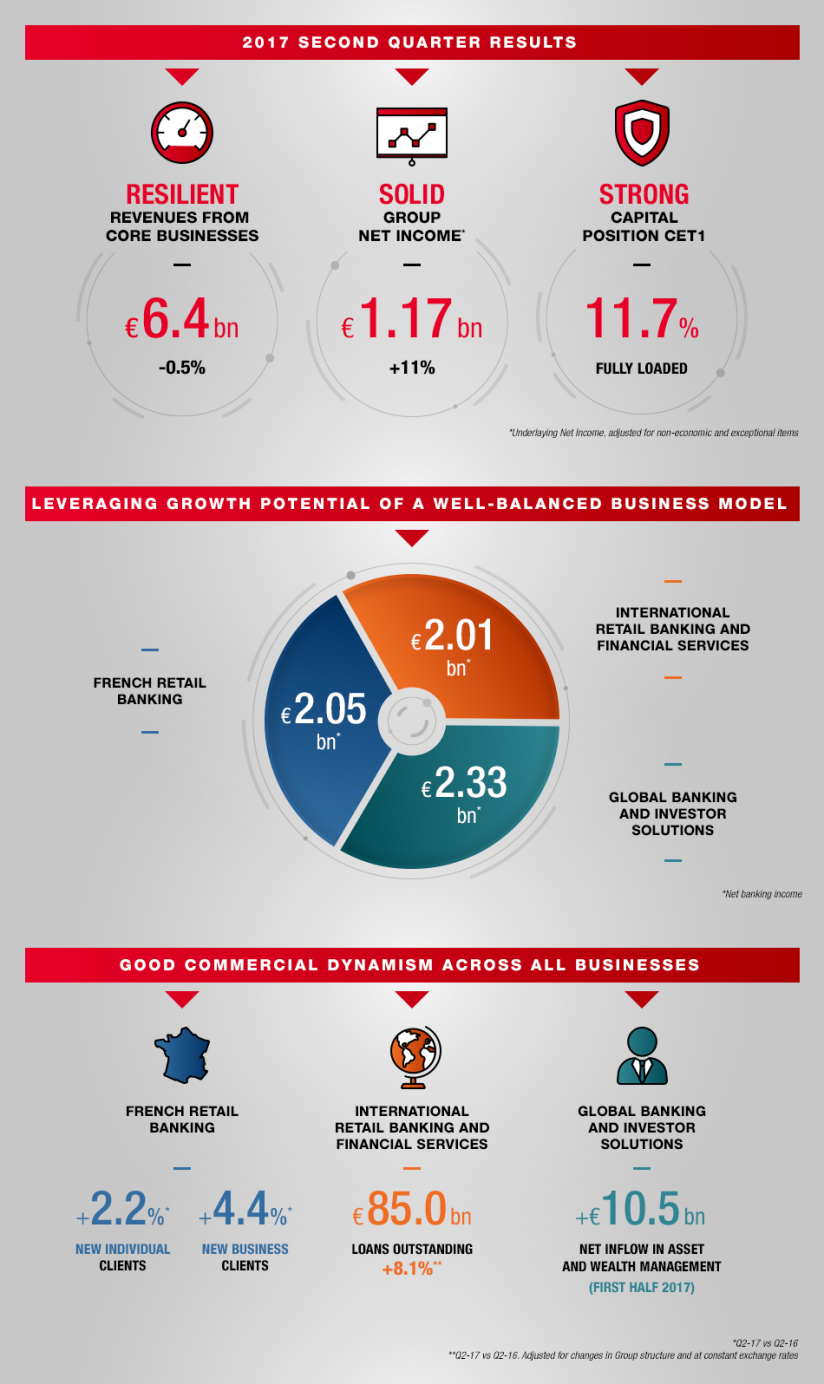

In a mixed economic and financial environment, Societe Generale posted sound results in Q2 2017, confirming the good commercial and operating performances achieved by the businesses at the beginning of the year and the relevance of its diversified and integrated banking model. The Group’s revenues were driven in particular by the growth in International Retail Banking & Financial Services, while profitability improved thanks to the control of costs and risks. The Group also continued to optimise its portfolio of activities with, in particular, the acquisition of 50% of the capital of Antarius (Crédit du Nord’s insurance company) and the stock market floatation of the ALD subsidiary.

-

Dear Shareholder,

In a mixed economic and financial environment, Societe Generale posted sound results in Q2 2017, confirming the good commercial and operating performances achieved by the businesses at the beginning of the year and the relevance of its diversified and integrated banking model. The Group’s revenues were driven in particular by the growth in International Retail Banking & Financial Services, while profitability improved thanks to the control of costs and risks. The Group also continued to optimise its portfolio of activities with, in particular, the acquisition of 50% of the capital of Antarius (Crédit du Nord’s insurance company) and the stock market floatation of the ALD subsidiary.

The Societe Generale Group delivered a good performance in all its businesses in Q2 2017.

As in previous quarters, International Retail Banking & Financial Services enjoyed robust growth in all businesses and geographical regions. The strong commercial momentum resulted in a further increase in quarterly revenues.

There was further confirmation of the commercial momentum of French Retail Banking’s three brands, with the expansion of the client base, +2.2% in the individual customer segment and +4.4% in the business segment. However, revenues continued to be adversely affected by the low interest rate environment, despite the gradual transition to a more fee-generating model.

Meanwhile, Global Banking & Investor Solutions operated in a less buoyant market environment. Q2 2017 was marked by the “wait-and-see” attitude of investors in conjunction with low volatility. As a result, revenues were slightly lower than in Q2 2016, which benefited from a more favourable market environment.

The Group also continued with the transformation of its business model and the optimisation of its portfolio of activities. This included, in particular, the stock market floatation of ALD in order to make it a leader in the mobility sector, and the acquisition of Antarius which strengthens the Group’s integrated bancassurance model. As announced at the beginning of the year, there has been an acceleration in the transformation of French Retail Banking to enable us to adapt to changes in the services requested by our customers. Finally, the controlled expansion, in terms of risks and costs, of our Global Banking & Investor Solutions’ activities enables us to benefit from additional growth drivers.

There was a limited increase (+1.2%) in operating expenses in Q2 2017. The increase reflects the acceleration of investments in the transformation of French Retail Banking, efforts to support the rapid growth of International Retail Banking & Financial Services and the effects of Global Banking & Investor Solutions’ cost savings plans.

The net cost of risk (excluding net change in the provision for disputes) was at the low level of EUR -191 million in Q2 2017, a substantial decline, confirming the structural improvement in the risk profile of the three business divisions.

Societe Generale generated Group net income of EUR 1,058 million in Q2 2017 and EUR 1,805 million in H1 2017.

The CET1 capital ratio stood at 11.7%, an increase of 10 basis points in Q2 2107. It includes, in particular, a provision for dividend of EUR 1.10 per share, corresponding to half the dividend paid for the whole of 2016.

In parallel and while continuing to work towards bringing past disputes to a close, Societe Generale is actively preparing the next stage of its strategy which will be presented on November 28th. The Group will draw on its new governance, both more agile and closer to customers, implemented as from September, which will enable it to continue to demonstrate the benefits of its diversified and integrated banking model.

Once again, I would like to thank you for your loyalty and the trust you have placed in our Group.

Frédéric Oudéa,

Chief Executive OfficerChanges indicated are in relation to Q2 2016

Results by business

Sound results.

French Retail Banking

International Retail Banking & Financial Services

Global Banking & Investor Solutions

Viewpoint

Entrepreneurs in action

“An engaged and responsible player in a changing world,” is the title of the Viewpoint article by Séverin Cabannes, Deputy Chief Executive Officer, in the Group’s Activity Report 2016-2017. At Societe Generale, we are convinced that entrepreneurial spirit is a powerful force for reinvention. Which is why we decided to give entrepreneurs, clients, partners and members of staff the opportunity to share their point of view in this year’s report.

Expert opinion

A market leader poised for further growth

Following ALD Automotive’s floatation on the stock exchange, Mike Masterson, Chief Executive Officer of ALD Automotive, discusses the reasons for the success of the largest IPO in Europe this year so far. “Our ambition is to go further and to become the market leader in mobility solutions.”

Innovation

TechWeek 2017 at the Dunes

The spotlight was on innovation at the start of July for TechWeek 2017, a major event held at the Group’s technological hub the Dunes in the east of Paris. Through numerous stands, conferences, workshops and showrooms, Societe Generale presented six of its principal innovations accelerating the Group’s digital transformation.

Citizen Commitment Time 2017

Embodying Societe Generale's social commitment, this annual event highlights the engagement of Group staff around the world. This year, over 40 countries are taking part with around 100 different sporting and charitable events taking place from May to October. In Paris, over two days in July, 1,450 staff pedalled 20,087km raising over €100,000. Worldwide, staff have now travelled more than 100,000km with all the kilometers transformed into monetary donation to charitable projects benefiting education and social integration through sporting and/or cultural activities.