Understanding our 2016 Annual Results

Frédéric Oudéa's editorial

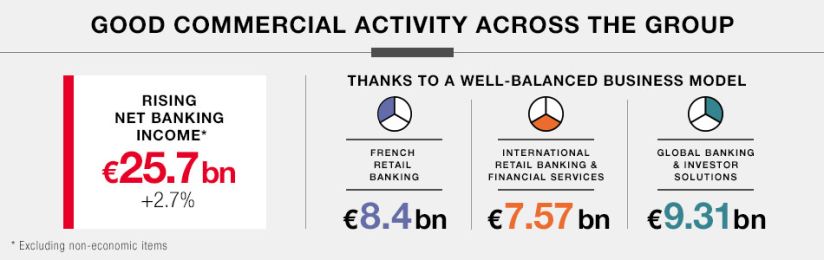

Our Group’s full-year results have grown in 2016, with revenues that rose by nearly +3% to €25.7 billion. The quality of our results reflects the good commercial and operating performances in all our businesses as well as rigorous control of costs and risks, and enables us to take a positive view of our transformation over the last three years. In an uncertain environment, the Group has benefited from its well-balanced banking model, the trust shown by its customers and the commitment of its staff.

-

Dear Shareholder,

The quality of our results reflects the good commercial and operating performances in all our businesses as well as rigorous control of costs and risks, and enables us to take a positive view of our transformation over the last three years. Our Group’s full-year results have grown in 2016, with revenues, excluding non-economic items, that rose by nearly +3% to €25.7 billion.

In an economic environment that is less buoyant and much more demanding on the regulatory front, we have simplified our banking model, optimised capital allocation and continued to invest in the businesses of the future, as we undertook to do in our 2014-2016 Strategic Plan. These efforts enable us to generally comply with the trajectory of the strategic and financial objectives set in 2014: we have demonstrated our potential for growth and operational excellence, and have significantly improved our structural profitability. The balance sheet has improved and all our regulatory capital and liquidity ratios are above the regulators’ requirements.

Our Group’s full-year results have grown in 2016, with revenues that rose by nearly +3% to €25.7 billion*. The quality of our results reflects the good commercial and operating performances in all our businesses as well as rigorous control of costs and risks, and enables us to take a positive view of our transformation over the last three years. In an uncertain environment, the Group has benefited from its well-balanced banking model, the trust shown by its customers and the commitment of its staff.

In 2016, French Retail Banking, with its three complementary brands (Société Générale, Crédit du Nord and Boursorama), enjoyed a solid commercial momentum and achieved good results in a low interest rate environment, while continuing to invest in the digital transformation process. The Group strengthened its French customer base, which now encompasses 11.5 million individual customers (+4% compared to 2015, with more than 400,000 new customers in 2016) and nearly 4,000 new business clients in 2016 (+4% compared to 2015). Against the backdrop of a gradual recovery in activity in France, the Group continued to assist individuals and businesses with the financing of their projects. Accordingly, average outstanding loans increased by nearly +3% in 2016.

International Retail Banking & Financial Services benefited from a good commercial momentum in all regions and businesses: International Retail Banking’s outstanding loans rose +6.6% confirming the dynamic activity in Europe and Africa, life insurance savings outstandings were up +3.7%, while Equipment Finance’s outstanding loans were up +5.5%. This good commercial performance resulted in an increase in revenues of +4%. The finalisation of the Group’s acquisition in April 2017 of the 50% share held by Aviva France in Antarius will significantly strengthen the position of the Group’s Insurance business through the Crédit du Nord network. Moreover, the Group intends to float its ALD subsidiary on the stock market in 2017 to make it a leader in mobility services, subject to market conditions. At the same time, it will retain control of ALD and continue to actively support an activity generating growth and added value, with substantial commercial and financial synergies within our businesses. This strategy illustrates our intention to seize new growth opportunities offered in an environment of technological change.

Global Banking & Investor Solutions has advanced in a market environment marked by political and economic uncertainty. Global Markets & Investor Services’ revenues proved resilient (-1.1%), providing further confirmation of the agility of our business model and the successful process of transformation undertaken since several years. We are continuing with efforts to further strengthen our leadership positions and market share, while at the same time controlling our costs and risks. The business’ expertise was recognised again in 2016, with the title of “Derivatives House of the Year”, awarded by IFR.

Group Net Income* totalled €4.1 billion in 2016, up +15.3%. These good results have enabled us to strengthen our capital, with a CET1 ratio of 11.5%, and to reach the medium-term target of 11.5% to 12.0% at end-2018 ahead of schedule. The Group now complies with all its prudential obligations.

We will therefore propose to the General Meeting on 23rd May that a dividend of €2.20 per share be paid in respect of the 2016 financial year, a 10% increase compared to 2015. We intend to continue on this path, maintaining our policy of distributing 50% of our earnings, excluding non-economic items, and with the aim of increasing the dividend.

Based on these solid foundations, Societe Generale intends to continue with the adaptation and digital transformation of its businesses, simplify its organisational set-up and roll out its Culture and Conduct programme in 2017.

The Group is also preparing a new stage in its development, with the presentation at the end of the year of a medium-term strategic plan showing our ability to provide even more value for our customers and shareholders.

Once again, I would like to thank you for your loyalty and the trust you have placed in our Group.

Frédéric Oudéa,

Chief Executive Officer

(*). Excluding non-economic items.

Variations are based on adjustments for changes in Group structure and at constant exchange rates compared to 2015.

Interview with Frédéric Oudéa

Frédéric Oudéa, CEO, discusses the Group’s 2016 Annual Results in an interview with EuroBusinessMedia (CEO-Direct).

Results by business

Good commercial and operating performances in all the businesses

French Retail Banking

International Retail Banking & Financial Services

Global Banking & Investor Solutions

Viewpoint

2017, uncertainty slowly fades

2017 is set to be a landmark year. After a year of surprises in 2016, we can expect plenty more uncertainties in the year ahead, but they are likely to gradually fade. Political challenges in particular will predominate: the arrival in office and first moves of the new US president, important elections in Europe, the start of Brexit negotiations, etc. These are all factors that will influence the global economy, and the future of Europe in particular.

Expert opinion

What course will the global economy take in 2017?

After a protracted period of sluggishness, global activity has begun to pick up and is expected to continue this way in 2017.

Innovation

FinTech: learn fast or fail fast

Banks can learn from FinTechs about the latest technologies and creating good user experiences, and FinTechs can learn from banks about regulatory compliance, distribution and large-scale processing. Everyone gets something out of the relationship – banks and FinTechs alike. So says Aymeril Hoang, Head of Innovation for Societe Generale.