Understanding our 2015 annual results

Frédéric Oudéa's editorial

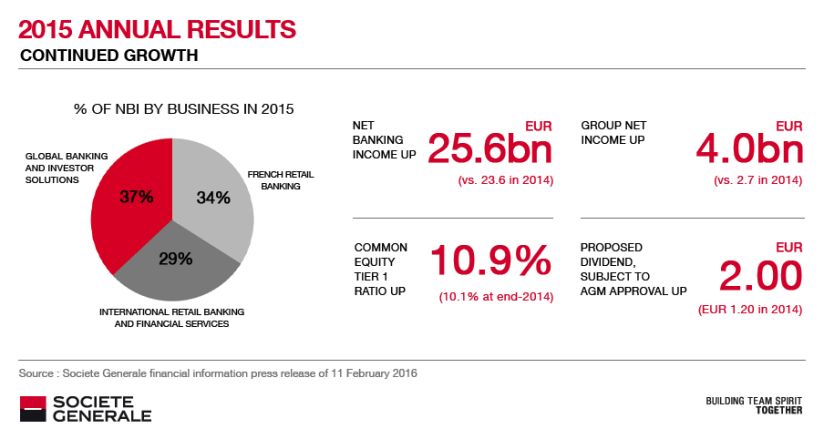

In 2015, our Group completed another stage in its transformation process, with Group net income of EUR 4 billion in 2015, substantially higher than in 2014. Our businesses demonstrated an excellent commercial momentum in an albeit lacklustre environment. The Group also confirmed its ability to create value over the long term, with tangible net asset value per share increasing 9% in 2015.

-

In 2015, our Group completed another stage in its transformation process, with Group net income of EUR 4 billion in 2015, substantially higher than in 2014. Our businesses demonstrated an excellent commercial momentum in an albeit lacklustre environment. The Group also confirmed its ability to create value over the long term, with tangible net asset value per share increasing 9% in 2015.

In 2015, we continued to progress in the implementation of our 2014-2016 strategic plan. The Societe Generale Group is able to draw on the strength of its balanced universal banking model based around its three major businesses: French Retail Banking, International Retail Banking & Financial Services and Global Banking & Investor Solutions. Once again in 2015, we demonstrated our ability to adapt and transform ourselves in the face of a challenging economic environment, increased regulatory and fiscal pressures and radical changes in our customers’ behaviour. Over the last few years, we have refocused our business portfolio around our core businesses, improved our credit origination, reduced our cost of risk, transformed and lowered our cost base. We have also accelerated the digital transformation of all our businesses and 2015 was a pivotal year in this respect.

Revenues were up +9% at EUR 25.6 billion in 2015, driven by the dynamism of all the businesses.

French Retail Banking experienced its most successful year in 10 years, in terms of winning new customers. Our three brands, Societe Generale, Crédit du Nord and Boursorama, opened 305,000 new accounts. Against the backdrop of a gradual pick-up in activity in France, the Group continued to assist individuals and businesses with the financing of their projects. As a result, outstanding loans increased by nearly 2% in 2015.

International Retail Banking enjoyed strong deposit inflow and robust loan growth in Europe and Africa. As for Russia, the situation is gradually improving. Insurance and Financial Services to Corporates provided further confirmation of their good performance and posted revenue growth of respectively +10%* and +13%*.

Financing & Advisory continued to expand. The growth in Financing & Advisory more than offset the decline in Global Markets, marked by unstable market conditions in second half. Accordingly, Global Banking & Investor Solutions’ revenues were up +1%*.

At the same time, we maintained strict discipline in the management of our costs and risks. Overall, we generated Group net income of EUR 4 billion in 2015, substantially higher than the previous year (+47%*).

These good results enable us to strengthen our capital: with a CET1 ratio of 10.9% and a leverage ratio of 4%, the capital targets announced in our strategic plan have already been achieved. The Group’s capital ratios exceed the regulatory requirements of the European Central Bank.

The dividend that will be proposed to the Annual General Meeting on May 18th amounts to EUR 2 in cash per share. It is substantially higher than in 2014 (EUR 1.20) and at its highest level for 7 years. It corresponds to a payout ratio of 50% of our net income, in accordance with our commitments.

In 2016 and in an environment that remains uncertain, we will pursue our strategy focused on the customer and a creator of long-term value. We will continue to place the customer and digital at the heart of the transformation of our business model. 2016 will be, I am convinced, another positive stage for Societe Generale.

Once again, I would like to thank you for your loyalty and the trust you have placed in our Group.

Frédéric Oudéa,

Chief Executive Officer

(*) When adjusted for changes in Group structure and at constant exchange rates

Results by business

Continued growth.

French Retail Banking

International Retail Banking & Financial Services

Global Banking & Investor Solutions

Teaming up with local businesses

Supporting businesses has always been the core purpose of Societe Generale, founded more than 150 years ago with the aim of "supporting the development of trade and industry in France." Today, more than ever, we are continuing on this path to help support the return to growth in France, in step with business leaders and their needs.

The point of view of Laurent Goutard, Head of Societe Generale Retail Banking in France

2016 global economic prospects: Overall fragility, regional divergences

The global economy has shown signs of fragility in late 2015 and early 2016, and the situation is unlikely to substantially improve this year. However, economic performances vary significantly from region to region. Indeed, although growth should slow in emerging countries, and notably in China, it should accelerate slightly in developed countries.

Read the analysis by François Letondu, Economist at Societe Generale

Societe Generale commits to the fight against climate change

Societe Generale Group, a world leader in the financing of energy, launches its climate policy, setting out a global framework that pulls together and strengthens the various initiatives taken by the Bank over many years to help finance the energy transition and reduce the carbon footprint of its activities.

You can also read...

Frédéric Oudéa's viewpoints from the LinkedIn Influencer program.

Latest post: European banks and the risk of being sidelined